Interested in turning $100,000 into $1 million? I used to think that was impossible until I got into multifamily real estate. You see, on my 1st three deals, I made more than $500,000 (and that was back in the late nineties). At the time, I thought I had just gotten lucky, but that didn’t stop me from creating my personal wealth plan. A plan I thought could turn $100,000 into $1 million.

Let me will walk you through my plan.

My plan was pretty straightforward:

- Invest $100,000 in a multifamily deal (as a passive investor).

- Hold that investment for five years and collect distributions.

- Sell the property.

- Pay the capital gains tax.

- Do it all over again with the money left over from sale (after tax).

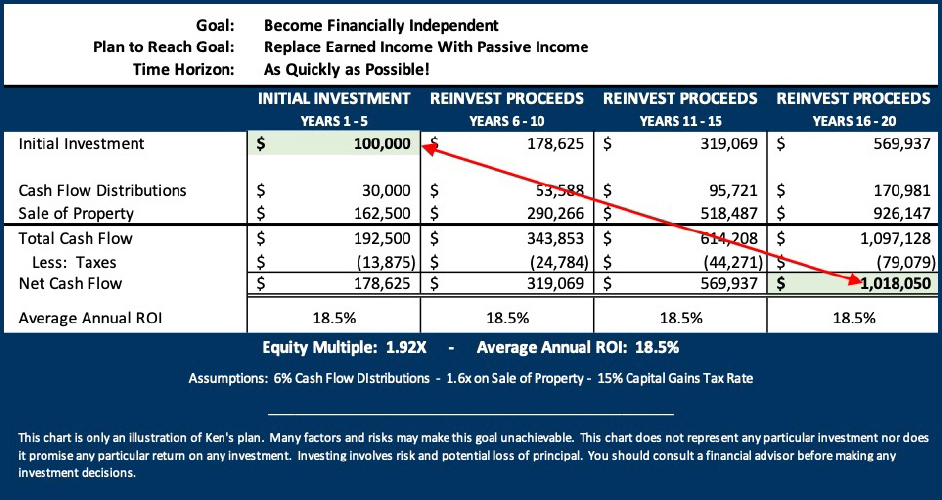

I determined that if I did this a total of four times, my $100,000 could turn into a little more than $1 million.

All I had to do was earn an overall annual rate of return of approx. 18.5%. Six percent of that would come from cash flow distributions and the rest would come from the sale of the property.

Here’s the plan laid out.

Now, of course you can challenge all my assumptions and tell me that I left out some details, but the plan is not flawed. As it turned out, we were able to beat the 18.5% most of the time (see our Verivest Verified track record here), so I can tell you with certainty, it is possible – it’s not guaranteed, but it is most definitely possible.

Multifamily real estate offers several advantages for investors seeking to build long-term wealth. Here are a few key reasons why you should consider it:

- Steady Cash Flow: Owning rental properties provides a consistent stream of income through rent payments from tenants. Unlike single-family homes, multifamily properties offer the benefit of multiple income streams, reducing your reliance on a single tenant.

- Appreciation Potential: Over time, the value of real estate tends to appreciate especially if you are able to increase rents. This means you could potentially profit from the sale of your multifamily property in addition to the ongoing rental income.

- Tax Benefits: Multifamily real estate investors can qualify for various tax deductions, such as depreciation, which can help lower your taxable income.

My experience is just one example of the success that can be achieved through multifamily real estate investing. If you’re interested in learning more about how this strategy can help you reach your financial goals, or about investing in multifamily real estate, check out the other resources we have on our website (www.kripartners.com) or you can always call us at (330) 467-1985.

Required Disclaimer:

All investments involve risk and may result in partial or total loss. Past performance is not indicative of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. Prospective investors should carefully consider their investment objectives, risks, charges and expenses, and should consult with a tax, legal and/or financial adviser before making any investment decision.