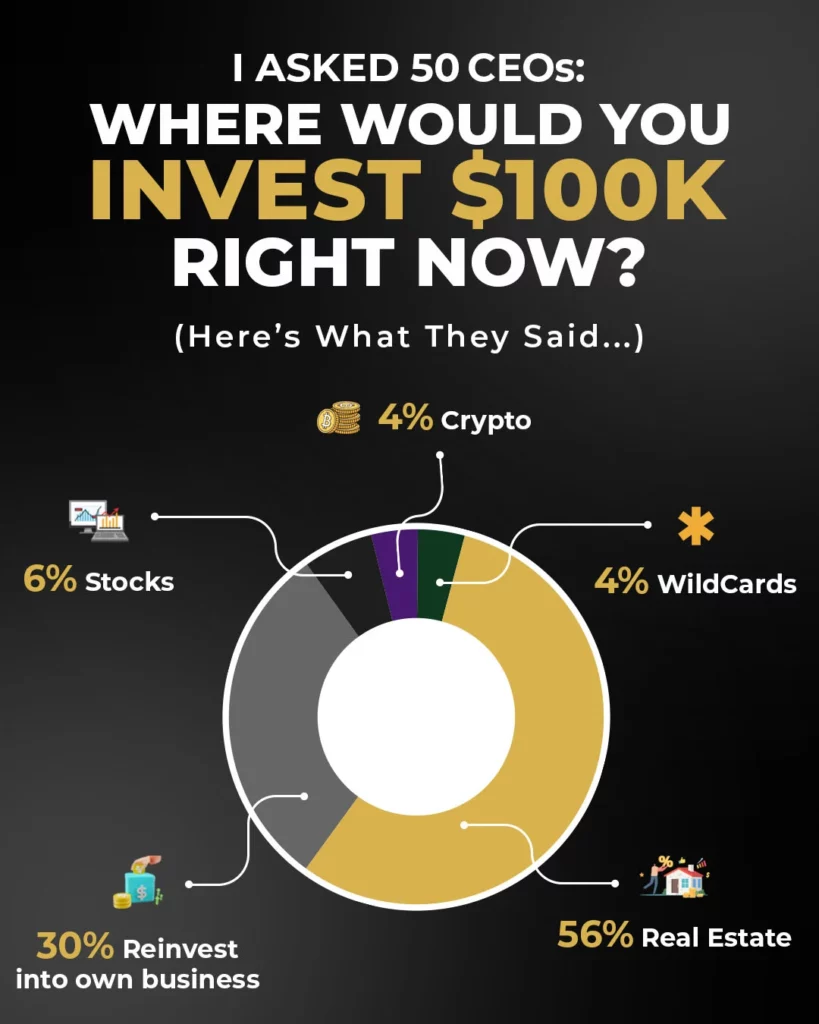

I Asked 50 CEOs: Where Would You Invest $100K Right Now? (Here’s What They Said…)

Here’s a fun thought exercise… suppose you had an extra $100,000 lying around, where would you invest it? A simple question, yet one that sparked a broad spectrum of responses when I recently asked it to 50 CEOs. From the predictable to the quirky, the answers painted a vivid picture of today’s current investment landscape. […]

How to Achieve Financial Freedom and Retire Early with Multifamily Real Estate

What if I told you that financial freedom and early retirement aren’t just for lottery winners and Silicon Valley unicorns? What if I showed you how I set out to use multifamily real estate to turn a relatively modest investment into a million-dollar nest egg? Intrigued? You should be. Today, I’m going to share a […]

Bank Failures: A Blessing in Disguise for Real Estate Investors?

You’ve probably been hearing about the recent bank failures, both domestically and internationally, and like many others, you might be wondering… “What does this mean for the real estate market? Should I get out now while I still have a chance?” I recently had the pleasure to speak with John Pearl on his podcast, Freedom […]

Ken’s Top 3 Lessons Learned from His First Multifamily Deal: A Real Estate Story 25+ Years in the Making

Remember what it was like to step into the world of multifamily investing for the first time? The excitement, the potential… and of course a lot of uncertainty. While we all wish for smooth sailing, it’s the rough waters that truly teach us how to navigate and conquer the real estate market. Because the truth […]

From Fear to Confidence: How Underwriting Can Make (And Save) You MILLIONS In Multifamily Investing

Do you remember the moment when you first discovered the world of multifamily investing? The excitement, the sense of limitless potential, and the dreams of financial freedom that danced through your mind? Along with that excitement, there was probably a healthy dose of fear and uncertainty. That’s totally normal… especially when you’re just starting out! […]

Ken’s 7 Rules For Choosing The Best Location For Your Next Multifamily Investment Property

You’ve probably heard the old real estate adage, “location, location, location,” more times than you can count… …But have you ever stopped to think about why it’s such an essential rule of thumb? If you’re a real estate investor (or simply someone who’s considering buying a property), understanding the importance of location is crucial. So, […]

The Magical Power of Compound Interest in Multi-Family Real Estate – Are YOU Harnessing It?

Have you ever wondered how a small initial investment can snowball into a massive fortune over time? The answer to this intriguing question lies in the magic of compound interest. As the famous saying goes: “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pays it.” […]

4 Golden Rules You Must Always Follow When Choosing a Multi-Family Real Estate Investment Firm

So you’ve decided to dip your toes into the world of passive real estate investing, but you’re feeling overwhelmed by the sheer number of options available. How do you know who to trust with your hard-earned money? Lucky for you, I’m here to help you cut through the noise and find the best multi-family real […]

Internal Rate of Return vs. Annual Return: What’s the Difference?

If you’re thinking about investing your hard-earned cash, you’ll quickly come across two key metrics that you may not initially understand: internal rate of return (IRR) and annual rate of return. Both are essential to understanding the performance of an investment, but they’re not the same thing. I was recently a guest on the Westside […]

Passing the Investment Baton: How to Teach Your Kids to Invest Early and Create Generational Wealth

Have you ever thought about how to pass down your wealth to future generations, beyond just material possessions and monetary gifts? What if you could create a legacy that would last for generations to come — one that teaches the importance of financial literacy and smart investing? But the REAL question is… where do you […]